In the rapidly modernizing B2B landscape, continuously enhancing customer experience (CX) is becoming increasingly crucial.

To provide a more comprehensive view of CX and drive strategic decision-making, this article explores the integration of conventional lagging metrics with newer advanced metrics

Product-market fit (PMF) is often discussed in the context of startups, but it's a critical concept for businesses of all sizes. Established companies introducing new products can greatly benefit from applying the same principles and measurement methodologies used by startups to assess PMF. Whether launching an entirely new product line or expanding into unfamiliar markets, understanding and achieving product-market fit ensures that these new ventures meet real customer needs and have a higher chance of success. By leveraging tools like the Sean Ellis Test, Net Promoter Score, and detailed user engagement metrics, established companies can strategically align their new offerings with market demands, just as effectively as any startup.

Product Market Fit test may also be used when replacing an existing product with a new one. Stay tuned for Product Efficiency Delta 4.

Product Market Fit (PMF) describes the degree to which a new product satisfies strong market demand. It is a crucial stage in developing a new product or service, indicating that the product meets the needs and wants of its target market.

Product/market fit has always been a fairly abstract concept making it difficult to know when you have actually achieved it. Yet many entrepreneurs have highlighted the importance of creating a product that resonates with the target market.

Y Combinator founder Paul Graham explains product/market fit as creating a product that people really want.

Sam Altman describes it as the point when your users start recommending your product to others without being asked.

Marc Andreessen says you can tell when a product isn't right for the market if customers don't really like it, few people talk about it, it doesn't sell quickly, reviews are so-so, sales take a long time, and many deals don't work out.

Marc Andreessen also notes that when a product fits the market well, sales take off quickly, money comes in quickly, and you need to hire more people immediately. The media and awards start paying attention; even investment bankers might be interested in your business.

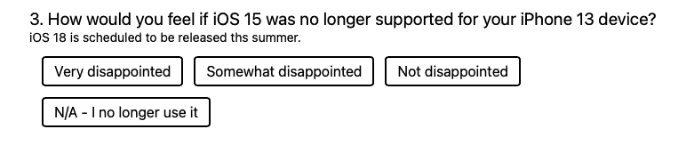

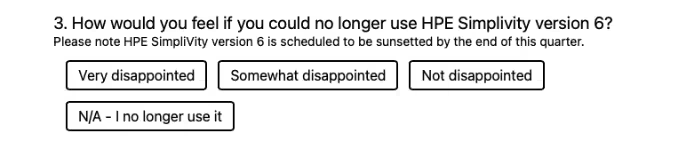

Sean Ellis, a startup advisor, developed a method for gauging whether a product is essential to its users by simply asking them how they'd feel if they could no longer use it.

The Sean Ellis Test — an attitudinal metric that gauges people's feelings about a product — is typically measured using a 4-point Likert scale.

How would you feel if you could no longer use{{product_name}}?

If over 40% of your users would be very disappointed without your product, it means you've made something they really need. Make sure to understand why it's so important to them before trying to attract more customers.

If less than 40% would be very disappointed, your product needs work. Use feedback to find out how to make it better, focusing on users who aren't fully satisfied. Sometimes, you might even need to make big changes to make your product a must-have.

You can also ask your customers how likely are customers to recommend the new product. Yes, the age old NPS may be used to collect attitudinal data.

Attitudinal metrics are qualitative and subjective, contrasting with behavioral metrics, which are quantitative and track actual behaviors.

As mentioned above, you can no longer choose between attitudinal and behavioral data alone; combining the two becomes essential.

Analyze how and how often the product is used. High engagement and retention rates can indicate PMF. Other important metrics include Daily/Monthly Active Users (DAU/MAU), Engagement, Adoption, Retention,

Cast.app supports PMF polls embedded on presentations, that outperform conventional survey based PMF.

Read about the Transformative Role of AI Agents.

This article aims to guide B2B executives through the complex landscape of customer experience metrics, advocating for a holistic approach that leverages multiple dimensions of customer data to drive business success.